Creating a budget, and sticking to it will absolutely change your life. Having a budget and knowing where your money is going is the key to financial freedom and one of the best things you can do for yourself. So, where do you start?

HOW TO CREATE A MONTHLY BUDGET – STEP 1 – Your Why

You need to figure out your why. Why do you want to make a budget? Is it because you don’t want to live paycheck to paycheck anymore? Is it because you want to pay off your debt? Is it because you want to save up money to take your dream vacation? Your why is going to be different than mine, and personal to you. But in order to actually stick to a budget, you need to have your why. The ability to sacrifice things in your life is only going to work if you have the motivation and reason to do so.

When you have your why, set a couple of initial goals for yourself that will get you excited to get started. At the very least, I would recommend a short term goal (one that might be pretty easy to accomplish) and a more long term goal so that you can keep the motivation going.

One important aspect to this is to do this with your partner if you have one. Getting their why and their goals is going to be SO important in making the budget work for your entire family.

HOW TO CREATE A MONTHLY BUDGET – STEP 2 – Determine your take home income

Next, you need to figure out what your take home pay is. This is not your annual salary divided by 12. You need to know your income after all the taxes and deductions are taken out. Make sure you think about all income streams too. Do you have a side hustle that brings in income? Do you get a bonus at the end of the year? Do you receive child support or government assistance of any kind? If you get money into your account, add it in.

If you have irregular income, you don’t get paid the same amount every month, then always budget for the worse case scenario. You might get paid $1700 one month and $1900 another month but you are never sure? Then always budget for $1700 a month. That will ensure that you never spend more than what you have, and it will always be extra money in your savings for you to do whatever you want with if you make more.

The same goes for if you make tips and you never know what they are going to be, plan for your worst night, anything above that, that you make will just be a bonus.

If you are paid every two weeks, that will mean that you get 2 extra paychecks per year than those that are paid twice a month. In 2020, that means that January and July you will be receiving ‘extra’ income. Make sure that you account for that when making your budget. For most months your income will be say $2400, but in January and July your income will be $3,600.

HOW TO CREATE A MONTHLY BUDGET – STEP 3 – Categorize Your Spending

Get together the last 3 months worth of credit card statements, bank statements and bills, and start highlighting/categorizing. You are looking to figure out what your fixed expenses are (any bills or subscriptions that are the same amount every and occur every single month or every single year), and what your variable expenses are (expenses that you have every month like groceries or gas, but that fluctuate in amount).

Common fixed expenses are: mortgage/rent, utilities, insurance, credit card fees, car payments, student loan payments, phone bill, internet bill etc… You can use the recurring expense tracker in the freebies section to help track these

Make sure that you also think about expenses that recur every year, but that might not show up in 3 months of history. Things like annual passes, property taxes, car insurance etc…

Some common variable expenses are: groceries, gas, dining out, entertainment, clothing, home, beauty, health, gifts etc…

Once you have finished doing this, add up all of your variable expenses in each category, and average the numbers for the 3 months. This will give you an idea of how much you’re spending on each of these categories per month.

HOW TO CREATE A MONTHLY BUDGET – STEP 4 – Figure out your 70%

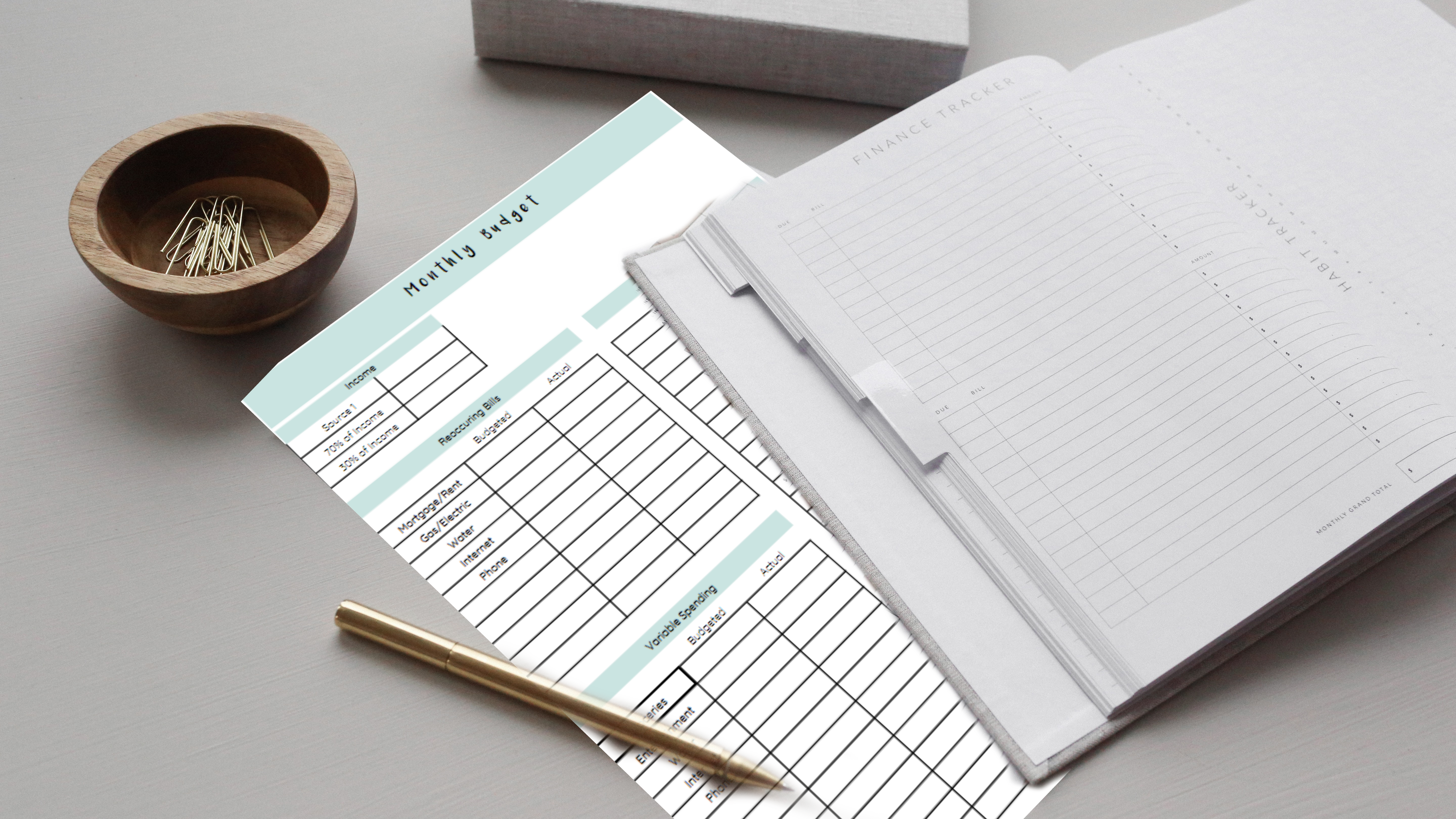

Now that you know how much money you take home and what your expenses are. You’re ready to start your budget. At this point, you need to either download my budgeting spreadsheet, or print out my monthly budget worksheet. They are both 100% free, and available in my freebies section. You will need a password to access it, so if you do not already have it, join my mailing list to get the password emailed to you (you can sign up at the end of this step 4 section).

Now that you have your worksheet, you are ready to get started. First, I am a firm believer that you should live within your means, and you should be able to live off of 70% of your income. The other 30% should go to your savings.

So, what you need to do first is figure out what 70% of your take home pay is. That number is what all of your fixed expenses and variable spending need to fit into. Write down your total take home pay, and the 70% and 30% numbers down in the income section of your worksheet.

HOW TO CREATE A MONTHLY BUDGET – STEP 5 – Total your fixed expenses

Next, you will want to list out every fixed expense that you have (monthly, quarterly, semi-annually, and annual).

For your monthly expenses, you will just write down the amount that you pay each month. For your other expenses, you will take the total amount due and divide it by the number of months you have to pay it off. That way you can put aside a little bit of money each month towards that bill. This is a sinking fund.

Speaking of sinking funds, there are some annual expenses that might vary every year, but that you will want to set some money aside for. These are things like Christmas gifts, valentines day, birthday parties etc… If you have an amount in mind that you would like to budget for those things each year, then make sure to turn those into sinking fund amounts too.

You can then add up all of your fixed expenses.

HOW TO CREATE A MONTHLY BUDGET – STEP 6 – Total your variable expenses

You will want to then list out every variable expense category that you wish to use and give an average monthly amount for them.

You can choose to separate your expenses into as many or as few categories as you wish. Some people have a different category for dining out, coffee, alcohol, entertainment etc…, while others choose to just have a grocery and family spending category only. You have to decide what will work best for you.

Then total up all of your averages to get your total monthly variable expense.

HOW TO CREATE A MONTHLY BUDGET – STEP 7 – Run the numbers

Now that you have everything listed out on your worksheet, you need to see how you are doing in your current state. Use the following equation:

Income – Fixed Expenses – Variable Expenses

If you are lucky, this number will come out to equal (or be less than) your 70% number. Unfortunately, for most of us, that is not the case and you will have some work to do.

HOW TO CREATE A MONTHLY BUDGET – STEP 8 – Adjust

So, for the majority of us, you’re going to have to do one of two things:

1. Make more money

2. Cut back on expenses

Increase your Income

There are ways to increase your income, but I am not going to focus on them in this post because I want you to be able to make your budget in your current state. And, a lot of us would have to trade time with the family in order to do it.

But to throw a couple of options out there: you could get a second job, you could start a side hustle, or you could simply ask your boss for a raise.

Cutting back expenses

Even though you might not want to do it, this is the MAIN way you are going to be able to get yourself within your budget. To reach those dreams and goals of yours it is going to require some sacrifice. But just remember your why! That is what will make the sacrifice worth it. Remember, anything worth doing is hard.

Some easy places to start when cutting back are the extras in life. These are things like:

- Gym membership – you can workout in your house or walk your neighborhood. There are a lot of free YouTube video workouts too.

- Cable – this is one of the easiest ones.. if you even have it. There are so many ways to get your TV entertainment these days

- Eating out – Make your food at home. Invite your friends to your house if you are craving the social aspect of dining out.

- Beauty/Grooming – do you really need to get your nails done or your hair professionally done?

- Cocktails/ Drinks out with friends – invite your friends over for drinks and a round of cards instead

- Sporting events/leisure activities (like going to the movies) –

- Coffee/tea – make these at home! it will save you so much

- Buying books – rent from the library instead!

- Fuel – walk more, take your bike or use public transportation

- Groceries – If you plan your meals and shop the weekly sales, you are bound to save some money. In general you should plan to spend about $100/person per month on groceries. Groceries includes household supplies too like paper towels, diapers, cleaner deodorant etc…

- Subscriptions – Netflix, Hulu, Spotify, magazines, newspaper etc.. Yes, it might suck, but if you need to find the money, this is one luxury item that you don’t NEED. Try renting movies, TV series, or books from the library or listen to free podcasts instead.

- Clothing – Work with what you already have, and if you are feeling like you HAVE TO HAVE new clothes, then unfollow people on social media that make you feel like you want new things too.

If you are willing to do something a little more extreme, you can sell your car in order to cut down on the monthly payment, or you have move into a more affordable house to cut down that expense.

Again, like I said, this part is TOUGH! I’m not going to sugar coat it. Sometimes it can downright suck. But just keep reminding yourself of why you are budgeting in the first place and that your sacrifice is worth it.

If you have cut out literally everything and still can’t get in that 70%, that is okay. For now, you may have to live off of 80%, 90% or even 99% and that is okay. Your goal should just be to put in the work so that eventually you can make your way down into the 70%.

HOW TO CREATE A MONTHLY BUDGET – STEP 9 – Save up

Now that you’ve figured out your income and expenses, you can work on your savings. You can use that 30% toward whatever you want. What are the goals you made at the beginning of this exercise? Work on those now! It might be debt payoff, a vacation, buying a car, owning a house, putting money into retirement or literally anything!

You don’t have to put the 30% toward one thing either. You can save for multiple things at the same time, and just divide the money up a little bit.

HOW TO CREATE A MONTHLY BUDGET – STEP 10 – Track your spending

Once you have your budget in place, you actually have to stick to it, and that is where tracking your spending comes in. Tracking your spending is ESSENTIAL to staying on track with your budget. Refer to your spreadsheet or tracker often.

A lot of people starting on this journey like to use the cash envelope method, but I don’t (here’s why). Instead I use my spreadsheet to manually track my expenses in each category that I have chosen. Once you have reached your determined amount in a month, the money for that month is gone, and you can’t spend in that category again until the next month.

And there you have it, a step-by-step guide on how to start a budget. It’s not easy, but you can change your financial situation if you are willing to put in the work. You will be surprised by how fast you can start saving money if you use this method.